Complete Guide to Home Responsibilities Protection (HRP) Claims (1978–2010)

Home Responsibilities Protection (HRP) was introduced in April 1978 to protect the State Pension rights of parents and carers who spent time out of paid work looking after children or sick/disabled people. If HRP is missing from your National Insurance (NI) record for years when you qualified, your State Pension may be lower than it should be — and you could be owed arrears once your record is corrected.

This complete guide explains what HRP is, who can claim, how to check your record, how to apply (online or with form CF411), what evidence you’ll need, common mistakes to avoid, and how Evanshaw can help.

HRP at a glance

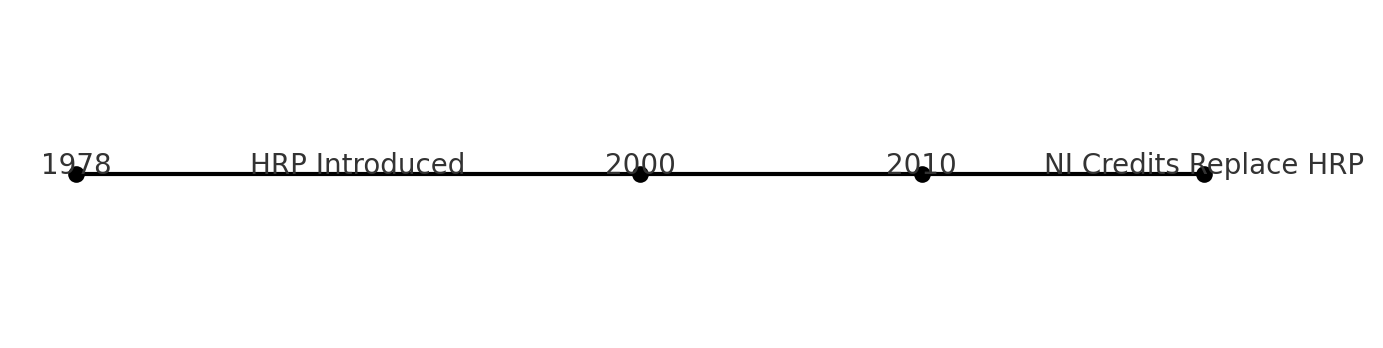

- Ran from 6 April 1978 to 5 April 2010

- Reduced the number of qualifying NI years needed for a full State Pension

- Converted into NI credits for people reaching pension age after 2010

- Available to parents on Child Benefit, foster/kinship carers, and carers on Income Support

- Average arrears when corrected can be worth up to £7,800

What did HRP do?

HRP reduced the number of qualifying NI years you needed for a full State Pension. For example, if you were a parent on Child Benefit, HRP ensured you weren’t penalised for years out of the workforce. From 2010, HRP years were converted into National Insurance credits.

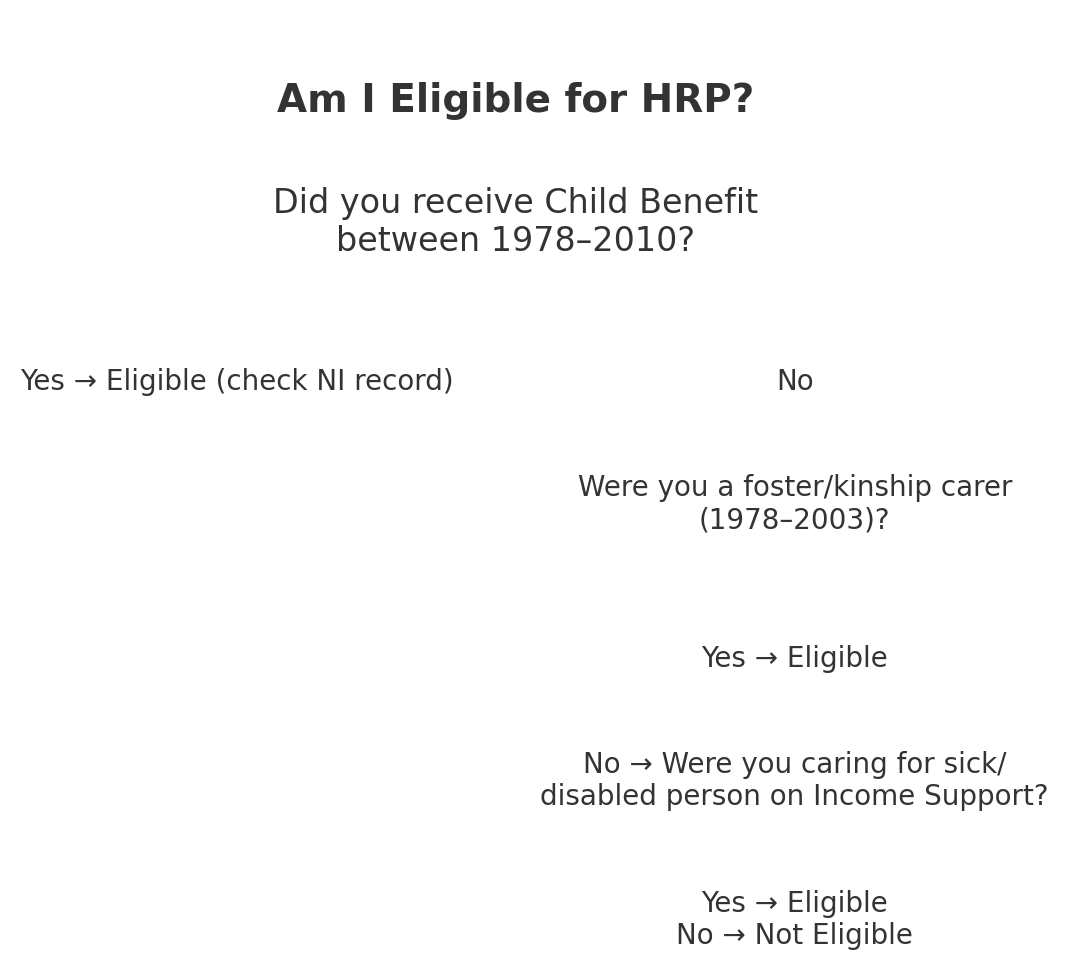

Who qualifies for HRP?

You may still be eligible to claim HRP for years between 1978 and 2010 if:

- You were the Child Benefit recipient for a child under 16 (especially if your claim began before May 2000).

- You were a foster or kinship carer registered with your local authority.

- You were caring for someone sick/disabled and received Income Support as a carer.

Note: If your Child Benefit claim started before May 2000, NI numbers were not always recorded properly, which is why many people are missing HRP credits.

👉 **Check your eligibility now with Evanshaw’s free tool:** [Check Now](https://evanshaw.co.uk/carer/check-now/)

Why are so many people missing HRP?

The main reason is that before May 2000, Child Benefit claim forms did not always capture the claimant’s NI number. This meant HRP was never added to their record, even though they were entitled to it. Other reasons include missing records from local authorities for foster carers and incomplete records for carers of sick/disabled people.

How to check your National Insurance record

You can check your National Insurance record on the official GOV.UK service here: https://www.gov.uk/check-national-insurance-record.

If years are missing where you were caring, you may be able to apply to have HRP added. This can increase your weekly State Pension amount and potentially provide backdated arrears.

📌 **Tip:** While you can check your record directly on [GOV.UK](https://www.gov.uk/check-national-insurance-record), Evanshaw can handle the whole process for you — from paperwork to HMRC/DWP follow-up. Start here: [Check Now](https://evanshaw.co.uk/carer/check-now/)

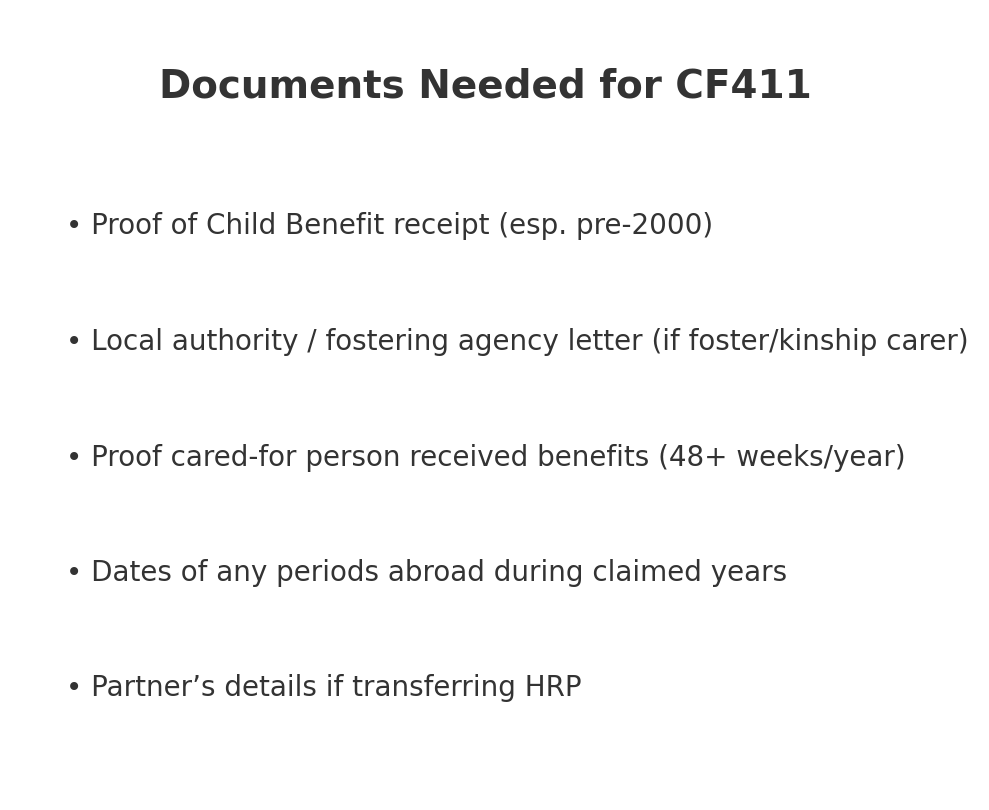

Evidence you will need

Depending on your situation, you may need:

- Proof of Child Benefit receipt (particularly pre-2000 claims).

- A letter from your local authority or fostering agency confirming foster/kinship carer status.

- Proof that the person you cared for was receiving relevant benefits for at least 48 weeks of the year.

- Dates you lived abroad, if any.

Create a year-by-year list of when you were caring and what evidence you hold. This makes the application process much smoother.

How to apply

There are two main ways to apply:

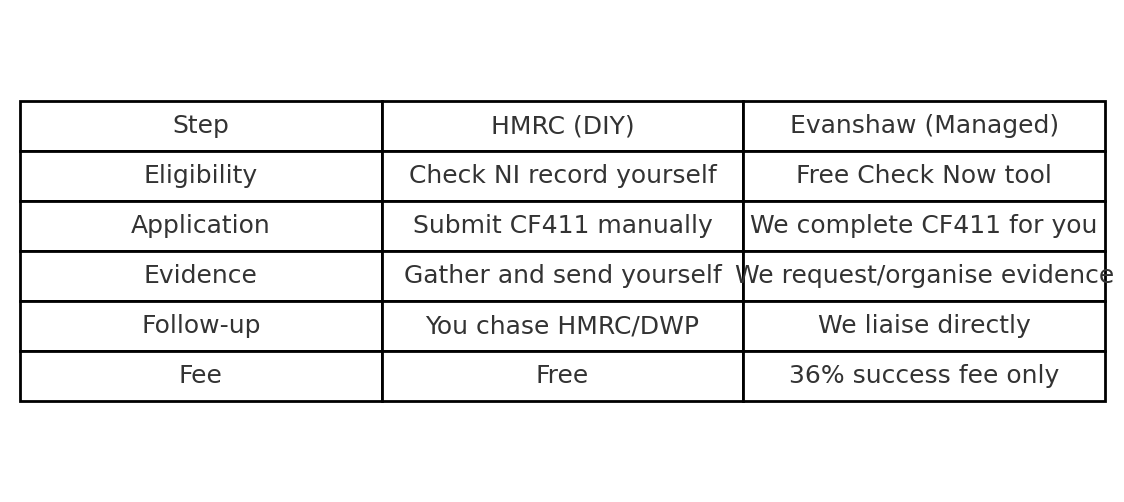

1. Online via GOV.UK: Upload your evidence as PDF or JPEG files.

2. By post using form CF411: Download it from GOV.UK, complete it, and send with supporting documents.

Form CF411 link: https://www.gov.uk/government/publications/national-insurance-home-responsibilities-protection

Common mistakes to avoid

- Assuming HRP was applied automatically with Child Benefit pre-May 2000.

- Sending incomplete or wrong evidence.

- Using the wrong form (CF411 vs CF411A for post-2010 NI credits).

- Forgetting to include time spent abroad.

Deceased claims (next-of-kin)

If someone has died but should have qualified for HRP, their NI record can still be corrected and any arrears may be paid to their estate. This is especially relevant for widows and widowers.

How long does it take?

Processing times vary but typically take 4–9 months. HMRC first updates the NI record, then DWP reassesses the pension. Delays are possible given high volumes of claims.

DIY vs Evanshaw support

The GOV.UK route is free but requires time, paperwork, and persistence. Many people choose Evanshaw because:

- We handle all paperwork and evidence gathering.

- We liaise with HMRC and DWP on your behalf.

- We ensure nothing is missed, including transfer cases.

- We only charge if successful (36% fee). See our Fees: https://evanshaw.co.uk/fees.html.

- Review our Terms & Conditions: https://evanshaw.co.uk/termsandconditions.html

Frequently Asked Questions

Q: How much can HRP add to my pension?

A: Each missing qualifying year can increase your pension by around £275 per year. Over a full retirement this can add up to thousands of pounds.

Q: Where can I find independent guidance?

A: Sites like [MoneySavingExpert](https://www.moneysavingexpert.com) and [Which?](https://www.which.co.uk) have published guides on HRP and State Pension underpayments, but only Evanshaw offers a managed claim service.

Q: Can HRP increase my State Pension now?

A: Yes, if missing HRP is added, DWP can reassess and pay arrears.

Q: Can I still apply if I never received a letter from HMRC?

A: Yes. You do not need to wait for a letter to apply.

Q: Is HRP the same as NI credits?

A: HRP covered 1978–2010. From 2010, credits replaced it.

Q: Can HRP be transferred between partners?

A: In some cases yes, if Child Benefit was in one partner’s name but the other was the main carer.

Final step

👉 Ready to claim? Use our Check Now tool to see if you qualify: https://evanshaw.co.uk/carer/check-now/