How HRP Affects Your State Pension: The Real Financial Impact

Home Responsibilities Protection (HRP) was designed to stop parents and carers losing out on their State Pension entitlement between 1978 and 2010. But when HRP credits are missing from your National Insurance (NI) record, the financial consequences can be huge. Even one missing year could mean thousands lost over your retirement.

In this guide, we break down exactly how HRP affects your State Pension, show real examples of the money at stake, and explain how Evanshaw helps maximise your entitlement.

HRP and State Pension – At a Glance

- Each qualifying year of HRP adds to your State Pension record.

- One missing year reduces your pension by around £275 per year.

- Over a 20-year retirement, that’s £5,500 lost for each missing year.

- Many claimants are owed arrears of £5,000–£15,000.

- Evanshaw corrects records and helps you recover lost income.

The link between HRP and your State Pension

Your State Pension is calculated based on the number of qualifying National Insurance years. HRP credits ensured parents and carers did not lose entitlement while raising children or providing unpaid care. When HRP is missing, your pension entitlement is lower than it should be.

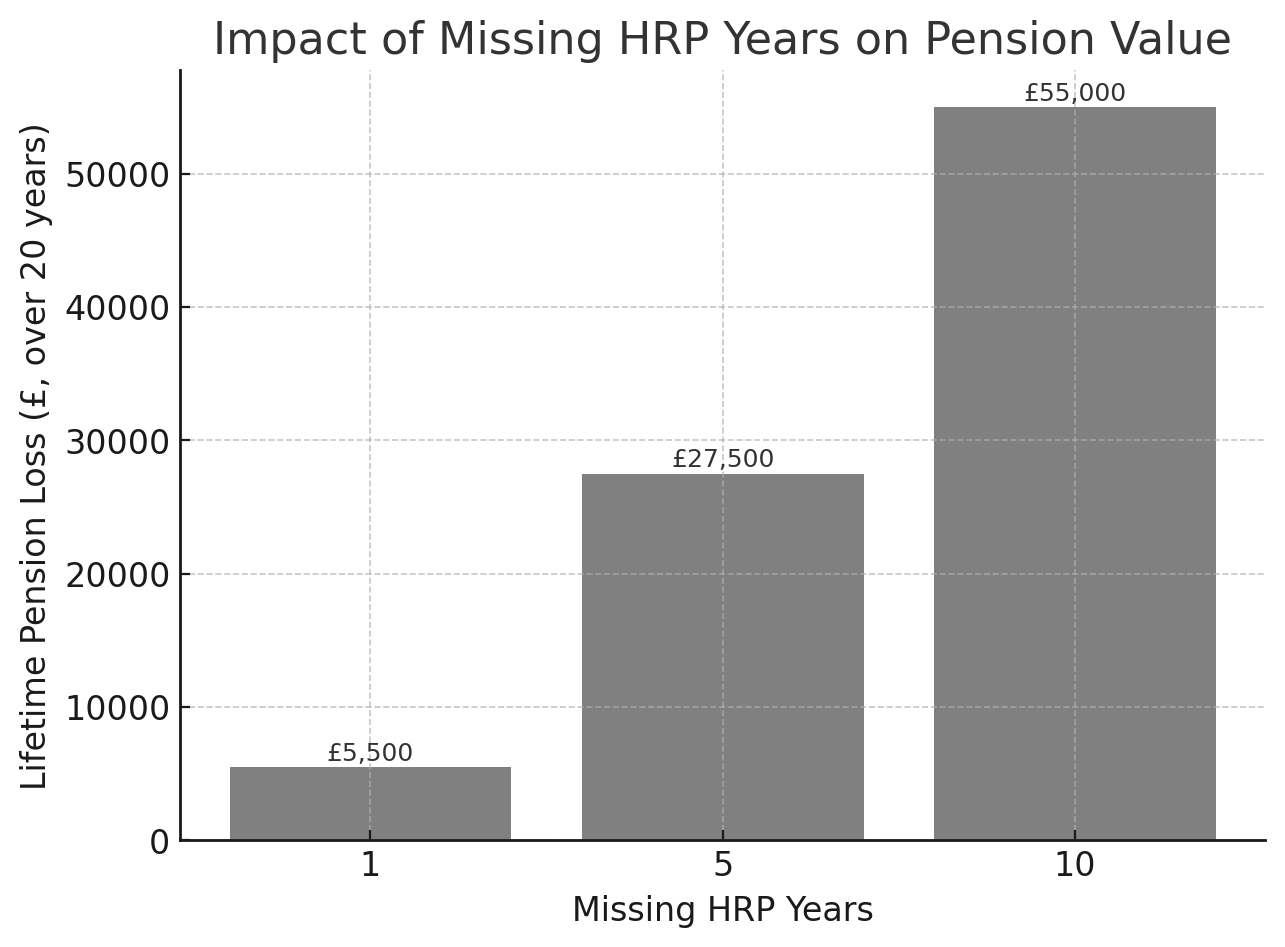

How much is HRP worth?

Each missing year of HRP reduces your State Pension by roughly £275 annually. Over a retirement, the numbers add up quickly:

- 1 year missing = £275 per year (~£5,500 over 20 years).

- 5 years missing = £1,375 per year (~£27,500 over 20 years).

- 10 years missing = £2,750 per year (~£55,000 over 20 years).

These figures don’t include back payments (arrears), which can add thousands in one lump sum.

👉 Want to know what your missing years could be worth? [Check Now](https://evanshaw.co.uk/carer/check-now/)

Real financial outcomes

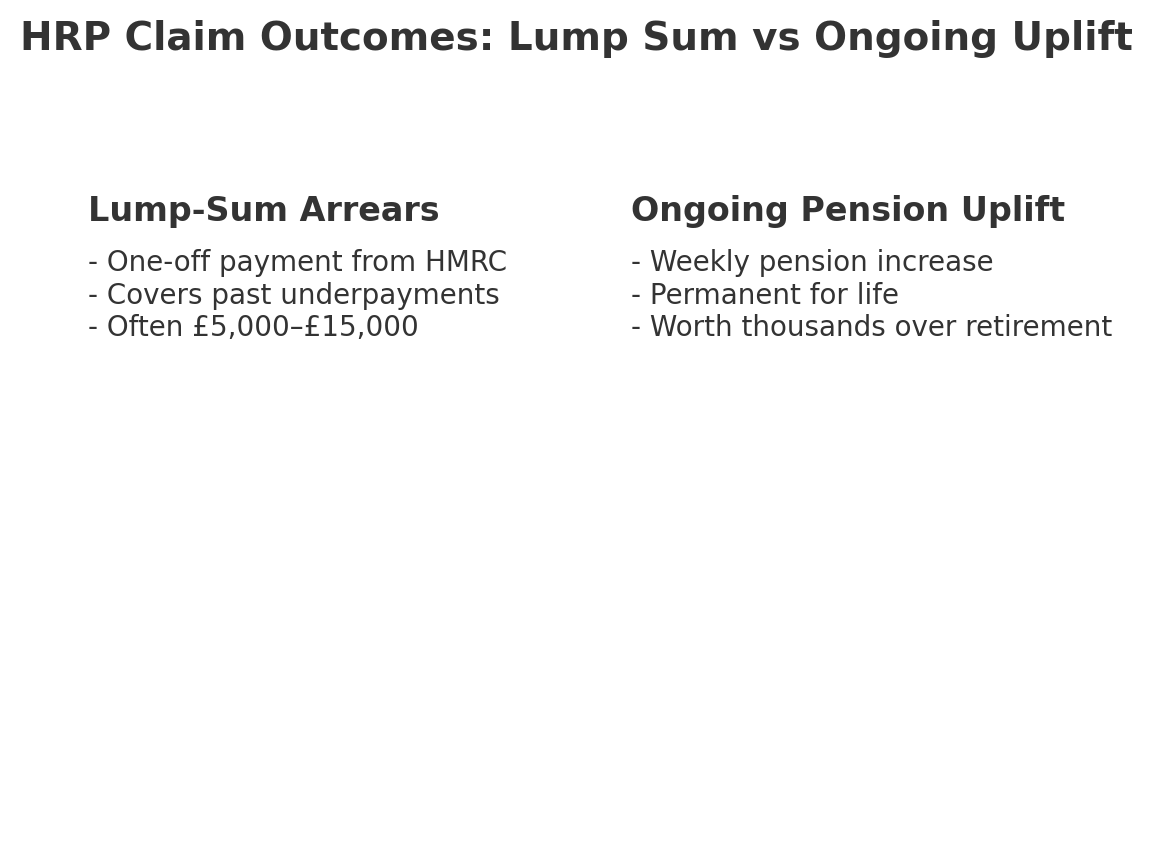

Correcting missing HRP credits can lead to two types of financial benefit:

- **Lump-sum arrears**: Back payments covering the underpaid years, often £5,000–£15,000.

- **Permanent weekly uplift**: An increase to your State Pension going forward, which lasts for life.

Who is most financially affected?

Certain groups are more likely to have missing HRP credits and therefore face bigger financial losses:

- Women born in the 1940s–1960s.

- Parents who claimed Child Benefit before May 2000.

- Carers who supported ill or disabled relatives.

- Foster or kinship carers (where local authorities failed to report correctly).

- Widows whose late spouses had missing years.

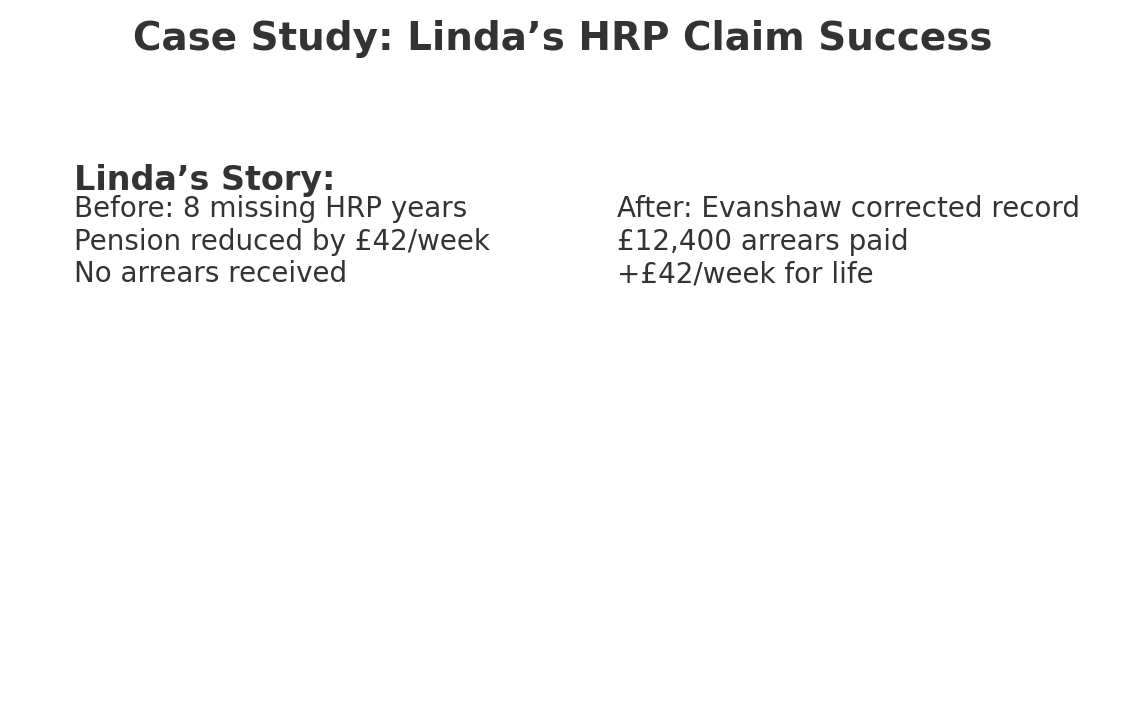

Case Study: Linda’s Story

Linda cared for her disabled son throughout the 1980s and 1990s. When she retired, she discovered 8 years of HRP were missing from her record. Evanshaw submitted a correction with supporting evidence from her local authority. Within 6 months, HMRC updated her NI record. Linda received £12,400 in arrears and her weekly pension increased by £42 for life.

DIY vs Evanshaw: The financial difference

While it’s possible to claim HRP credits directly via HMRC using form CF411, mistakes or missing evidence can delay your claim by months or even years. Evanshaw ensures everything is filed correctly the first time, reducing delays and maximising your chances of success.

We work on a No Win, No Fee basis — only charging 36% of arrears if your claim is successful. See [our Fees](https://evanshaw.co.uk/fees.html) for details.

Frequently Asked Questions

Q: How much can HRP add to my State Pension?

A: Each year adds about £275 annually. Multiple missing years can add thousands.

Q: Is there a maximum cap on arrears?

A: There’s no official cap — arrears are based on underpaid amounts since pension entitlement began.

Q: Can widows or estates inherit arrears?

A: Yes. If someone has died, next-of-kin or estates can receive back payments.

Q: Does Evanshaw guarantee a payout?

A: HMRC makes the final decision, but Evanshaw improves accuracy and success rates.

Q: Can I still apply if I retired years ago?

A: Yes. HRP corrections can be made after retirement.

Final Step

👉 Missing HRP credits could mean losing thousands in pension income. Don’t miss out — [Check Now](https://evanshaw.co.uk/carer/check-now/) with Evanshaw today.