HRP for Carers Without Child Benefit: What Counts as Evidence

If you regularly cared for a partner, parent or disabled child between 1978–2010 but didn’t claim Child Benefit, you might still qualify for Home Responsibilities Protection (HRP). The key is clear, date-anchored evidence that shows who you cared for, when, and how intensively.

Who this applies to

- You provided day-to-day care for months or years.

- The person you cared for had a long-term illness or disability.

- Your work was reduced, irregular, or paused due to caring.

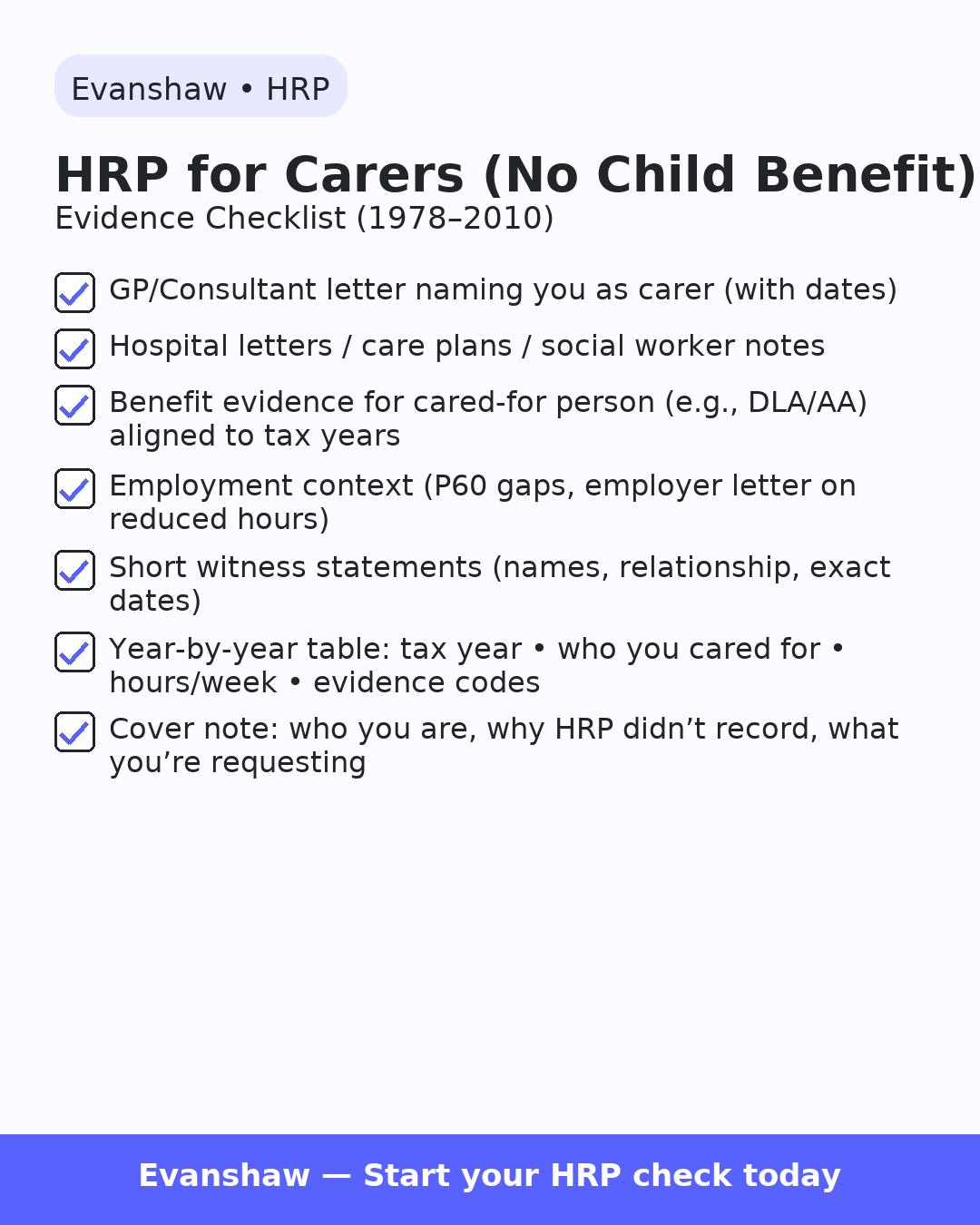

Evidence that helps (match it to tax years)

- Medical letters from a GP/consultant naming you as a main/regular carer, with dates.

- Hospital letters, care plans, social worker notes that reference your role and timeframe.

- Benefit evidence for the cared-for person (e.g., historic DLA/Attendance Allowance references) aligned to specific tax years.

- Employment context: employer letters, P60 gaps, or records showing reduced hours because of caring.

- Short witness statements (family/professionals): one paragraph, include names, relationship, and exact dates.

Tip: Decision-makers prefer specific, year-matched proof over general statements.

How to package it so it’s easy to approve

- Build a year-by-year table (include only the years you’re claiming, 1978–2010): Tax year | Who you cared for | Condition | Hours/week (estimate) | Evidence codes (A1, B2…).

- Label documents with simple codes: A-series (medical/care), B-series (benefits), C-series (identity/address links), D-series (employment).

- Keep originals safe; submit clean copies.

- Add a half-page cover note: who you are, which years, why HRP didn’t record, and what you’re asking to be credited.

Common pitfalls to avoid

- Evidence without dates or with the wrong years.

- Vague “I was the carer” statements with no documents attached.

- Submitting a pile of papers without an index.

What happens after submission

- DWP/HMRC assess whether the HRP criteria are met for each year.

- If approved, affected years are added as protected on your NI record.

- Your State Pension forecast may improve once records update.

Not sure your papers are enough? Evanshaw can audit your evidence and assemble a compliant HRP pack. Start your secure upload today.