HRP for Migrants & Returnees: Proving Residence and Care

👉 Quick Action: Check Your HRP Eligibility Now

https://evanshaw.co.uk/carer/check-now/

HRP Quick Facts

- HRP applied from 1978 to 2010.

- HRP protected parents and carers by reducing NI qualifying years.

- Corrections today can increase State Pension and trigger arrears.

- Evanshaw handles evidence, forms, and liaison with DWP/HMRC.

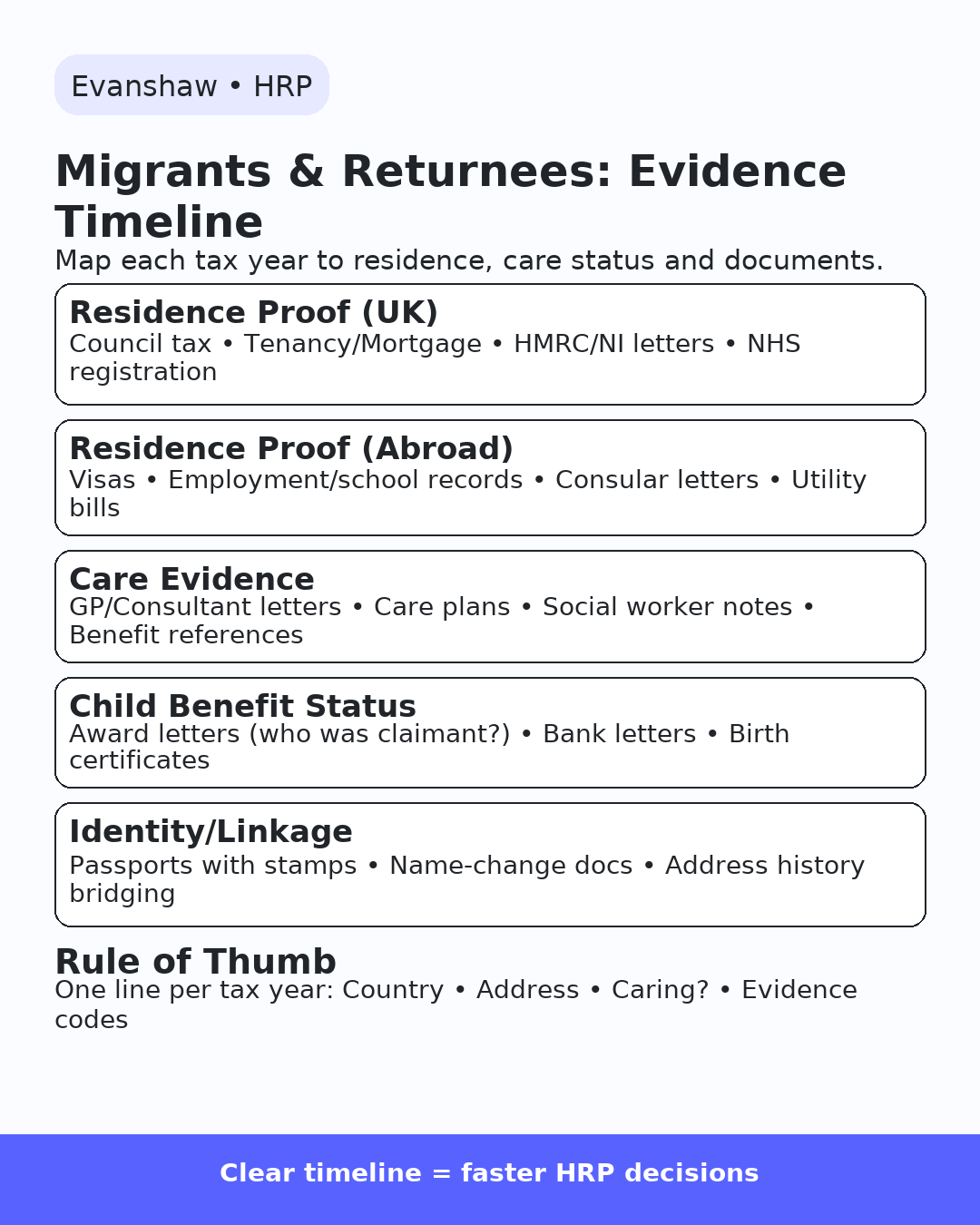

Build a Single, Date‑Anchored Timeline

List each tax year (1978–2010) with: country, address, caring status, and evidence codes.

This lets case‑workers see eligibility year‑by‑year at a glance.

Residence Trail to Compile (UK & Abroad)

- UK: council tax bills, tenancy/mortgage, HMRC/NI letters, NHS registration, school letters for dependants.

- Abroad: visas, residence/work permits, employment contracts, school/medical records, utilities in your name.

- Passports with entry/exit stamps where available.

Care Evidence Still Matters

- GP/consultant letters naming you as main/regular carer, with dates.

- Hospital letters, care plans, social worker notes referencing your role.

- Benefit references aligned to specific tax years.

- If Child Benefit wasn’t paid in the UK, focus on the care narrative with precise dates.

Recommended Annex Layout

- Annex A: Year‑by‑year timeline (Country • Address • Caring? • Evidence codes).

- Annex B: Residence proof indexed to years (UK & abroad).

- Annex C: Care/medical evidence, year‑matched.

- Annex D: Child Benefit claimant evidence.

- Annex E: Identity & linkage (name changes, passport stamps, address bridges).

Tip: One line per tax year with document codes beats a bundle of unlabelled papers.

Case Study

Example: A self-employed carer missed HRP because Child Benefit was in a partner’s name. After Evanshaw re-linked the record and submitted care evidence, 6 years were restored and the pension forecast rose accordingly.

Frequently Asked Questions

Q: Can I still claim HRP now?

A: Yes. HRP corrections can be made today for 1978–2010 years.

Q: Does Carer’s Allowance automatically give HRP?

A: No. They are separate; HRP requires its own evidence/recording.

Q: Will this increase my State Pension?

A: Corrected years can improve your forecast and may trigger arrears.

Q: Do I need originals?

A: Keep originals safe and submit clean copies. We’ll index everything in the annex.

Final Step

Don’t leave eligible years unclaimed. Evanshaw packages your evidence, submits correctly, and manages follow‑ups for you.

👉 Check Your Eligibility Now: https://evanshaw.co.uk/carer/check-now/