HRP & Self-Employment: Gaps, Class 2/3, and Credits

Many carers and parents combined self-employment with childcare. HRP can protect qualifying years even when Class 2 contributions were irregular — but only if it’s recorded. Here’s how to approach gaps sensibly so you don’t overpay for top-ups.

Typical scenarios

- You dipped in/out of self-employment while caring for children or a family member.

- You missed Class 2 payments in some years while your caring responsibilities were high.

- Your NI record shows gaps where HRP should apply (1978–2010).

What to check first

- Your NI record for every tax year between 1978–2010.

- Whether you were the Child Benefit claimant (and if not, who was).

- Any care evidence (medical letters, care plans, social worker notes) that aligns to the missing years.

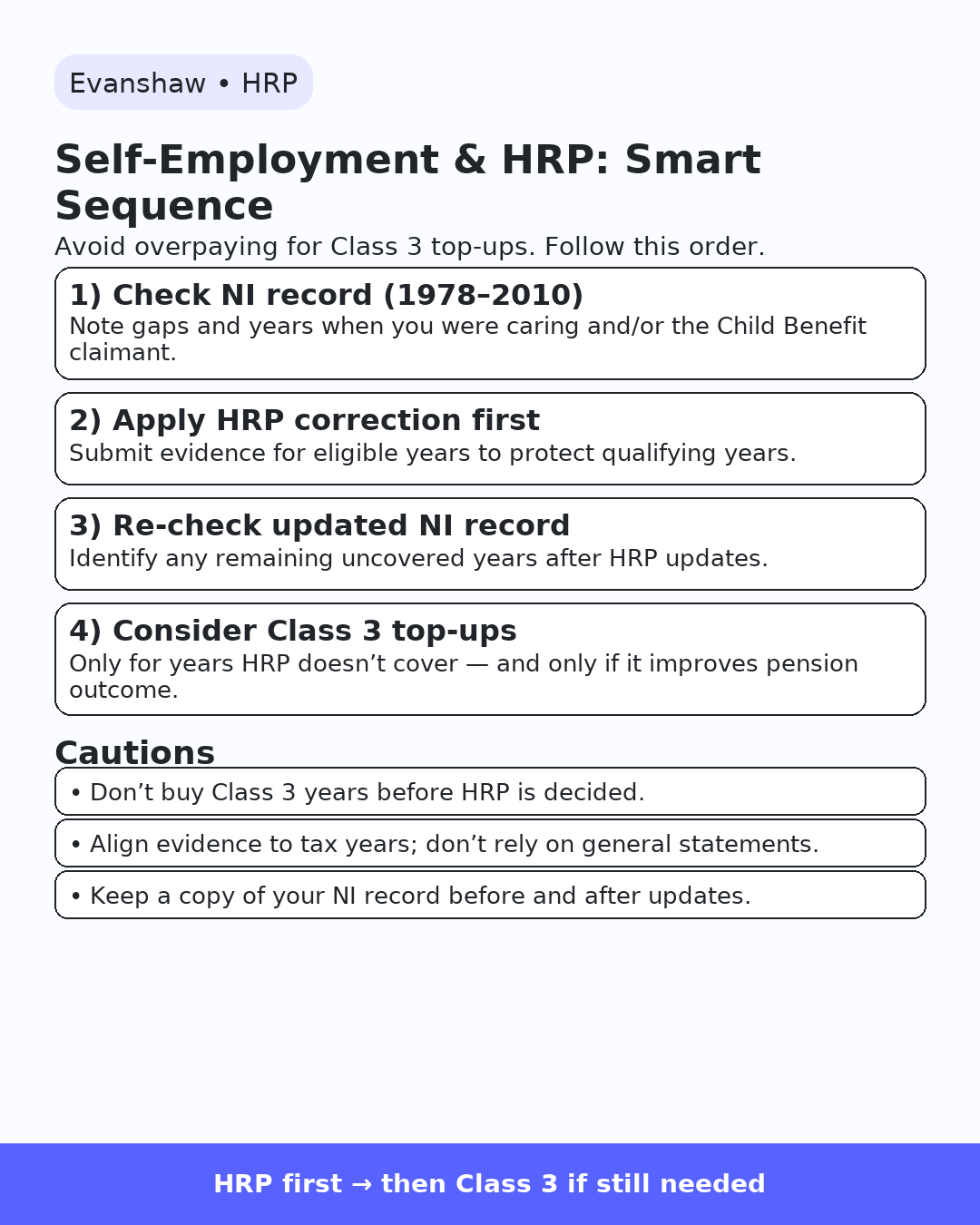

Close gaps in the right order

- Apply for HRP correction first to add protected years where eligible.

- Once HRP decisions update your NI record, re-check what remains uncovered.

- Only then consider voluntary Class 3 top-ups for years HRP won’t cover.

- If you also had employment/self-employment overlaps, include context letters or records.

Tip: Buying Class 3 years before HRP is decided can waste money — fix the record first, then top-up only if it still benefits your pension.

Evidence that helps for self-employed carers

- Child Benefit award letters naming the claimant for specific years.

- Medical/care evidence that shows your caring role and dates.

- Business records that explain irregular income (where relevant).

- Brief employer/client statements if you paused or reduced contracted work.

A simple annex structure

Create an annex with two parts: (1) a year-by-year HRP table; (2) a top-up review table for any remaining gaps after HRP.

- HRP Table: Tax year • Basis (Child Benefit/Carer) • Claimant • Evidence codes (A/B/C/D).

- Top-Up Table: Tax year • Current status • HRP status • Consider Class 3? • Estimated benefit.

After submission

- DWP/HMRC review HRP eligibility and update your NI record.

- Re-run your State Pension forecast to see the effect.

- If gaps remain, assess cost/benefit of Class 3 for those specific years.

Want a clean, cost‑smart plan? Evanshaw prioritises HRP first, then advises on any remaining top-ups. Start your review today.