Missing HRP Credits on Your NI Record? Common Reasons & How to Fix Them

Thousands of people across the UK are missing vital Home Responsibilities Protection (HRP) credits from their National Insurance (NI) record. If HRP is missing, your State Pension may be lower than it should be — sometimes by thousands of pounds over a lifetime. The good news is that missing HRP can often be fixed with the right steps.

In this guide, we explain why HRP credits go missing, what it means for your pension, how to check your record, and how to correct errors quickly.

HRP Missing Credits – At a Glance

- HRP ran from 1978–2010 and protected parents/carers from losing State Pension years.

- Many records (especially pre-2000 Child Benefit claims) never recorded HRP properly.

- Each missing year can reduce pension by around £275 per year.

- Claims can still be fixed using form CF411 or via Evanshaw’s managed service.

- Average back payments are up to £7,800.

Why do HRP credits go missing?

There are several common reasons HRP is absent from people’s NI records:

1. **Pre-2000 Child Benefit claims** – before May 2000, Child Benefit forms did not always ask for NI numbers, so HMRC could not link HRP to the parent’s record.

2. **Foster/kinship carers** – local authorities often failed to report care arrangements correctly.

3. **Carers on Income Support** – paperwork not filed or benefits not linked correctly.

4. **HMRC/DWP errors** – administrative mistakes where records were never updated.

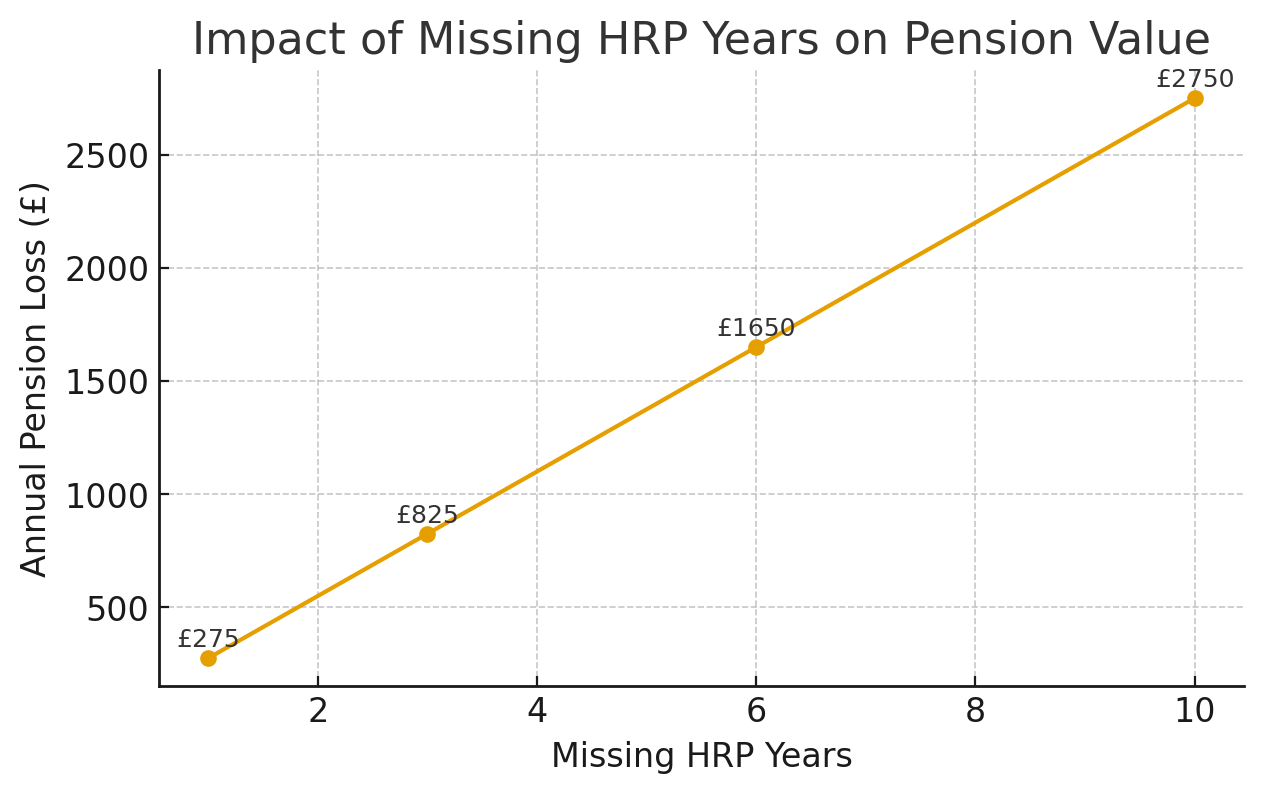

How missing credits affect your State Pension

Every missing qualifying year reduces your State Pension entitlement. On average, one missing year costs about £275 per year of pension income. Over a 20-year retirement, that could mean £5,500 lost.

Example: If 6 years of HRP are missing, your pension could be reduced by £1,650 per year, or £33,000 over a lifetime.

How to check if HRP credits are missing

You can check your National Insurance record online at: https://www.gov.uk/check-national-insurance-record

Look for missing years between 1978 and 2010. If you claimed Child Benefit or were a carer during those years but they do not appear on your record, you may be entitled to HRP corrections.

How to fix missing HRP credits

There are two main ways to correct missing HRP credits:

• **DIY via HMRC** – Complete form CF411 (download here: https://www.gov.uk/government/publications/national-insurance-home-responsibilities-protection). Provide supporting documents such as Child Benefit award letters or local authority confirmations.

• **Via Evanshaw** – We manage the entire process on your behalf. From eligibility checks, paperwork, and evidence collection, to chasing HMRC/DWP for updates. We only charge if successful (36% fee). Start here: [Check Now](https://evanshaw.co.uk/carer/check-now/).

Case Example: Anne’s Story

Anne raised two children between 1982 and 1998. When she reached pension age, she found 5 years of HRP missing from her NI record. This reduced her pension by £1,400 per year. With Evanshaw’s help, Anne’s record was corrected within 5 months. She received £9,500 in back payments and her weekly pension increased permanently.

Common pitfalls when fixing HRP credits

- Submitting the wrong form (e.g., CF411A instead of CF411).

- Missing or incomplete supporting evidence.

- Assuming Child Benefit was automatically linked to HRP before May 2000.

- Delays due to not chasing HMRC for updates.

Evanshaw avoids these pitfalls by ensuring everything is filed correctly first time.

Frequently Asked Questions

Q: Can I apply for HRP credits if I’ve already retired?

A: Yes. If your record is missing HRP, it can still be corrected, and arrears paid.

Q: Can widows or next-of-kin claim HRP?

A: Yes. HRP can be corrected posthumously and arrears may be paid to the estate.

Q: How far back can HRP be backdated?

A: HRP covers 1978–2010. Claims can still be made now.

Q: Do I need original Child Benefit letters?

A: Not always. Evanshaw can often obtain alternative evidence from HMRC/local authorities.

Q: Is it faster if I use Evanshaw?

A: HMRC’s workload sets overall timelines, but Evanshaw reduces avoidable delays by filing complete, organised claims.

Final Step

👉 Missing HRP credits could cost you thousands in retirement income. Take the stress out of claiming — [Check Now](https://evanshaw.co.uk/carer/check-now/) with Evanshaw today.