Who Qualifies for HRP? Eligibility Guide for Parents, Carers & Widows

One of the biggest sources of confusion around Home Responsibilities Protection (HRP) is eligibility. Many parents, carers and widows don’t realise they qualify for HRP credits — or assume they do when in fact they don’t. This guide sets out who is eligible, who isn’t, and how to make sure you don’t miss out on valuable State Pension entitlement.

HRP Eligibility – At a Glance

- HRP applied between 1978 and 2010.

- Parents who claimed Child Benefit usually qualify (but only if NI numbers were recorded).

- Carers and foster carers can qualify if evidence was provided.

- Widows and next-of-kin can claim on behalf of someone who has died.

- After 2010, NI credits replaced HRP.

Parents & Child Benefit Claimants

The most common route to HRP was through Child Benefit. If you were the parent or guardian who received Child Benefit between 1978 and 2010, you likely qualified for HRP. However, there are key caveats:

- Before May 2000, Child Benefit forms did not always ask for NI numbers. If your NI number wasn’t recorded, HRP may never have been linked to your NI record.

- Either parent could qualify — not just mothers — provided they were the named Child Benefit recipient.

- Step-parents and guardians could also qualify if they were the official Child Benefit claimant.

👉 Unsure if you qualify? [Check Now with Evanshaw](https://evanshaw.co.uk/carer/check-now/)

Carers & Foster Carers

HRP also protected carers looking after sick or disabled relatives, and foster/kinship carers. Issues arose because:

- Local authorities sometimes failed to report foster care arrangements correctly.

- Carers receiving Income Support were not always recorded properly.

- HRP was separate from Carer’s Allowance — many carers wrongly assumed one covered the other.

Widows & Next-of-Kin

HRP can still be corrected after someone has died:

- Widows may inherit pension entitlement if their spouse’s NI record was missing HRP credits.

- Next-of-kin can apply for HRP corrections on behalf of the deceased.

- Estates may receive arrears in a lump sum, often amounting to thousands of pounds.

Who does NOT qualify for HRP?

- Parents who never claimed Child Benefit during 1978–2010.

- Carers without any supporting evidence of their role.

- Claims after 2010 (covered instead by National Insurance credits).

- People who assumed HRP was applied automatically without making a valid claim.

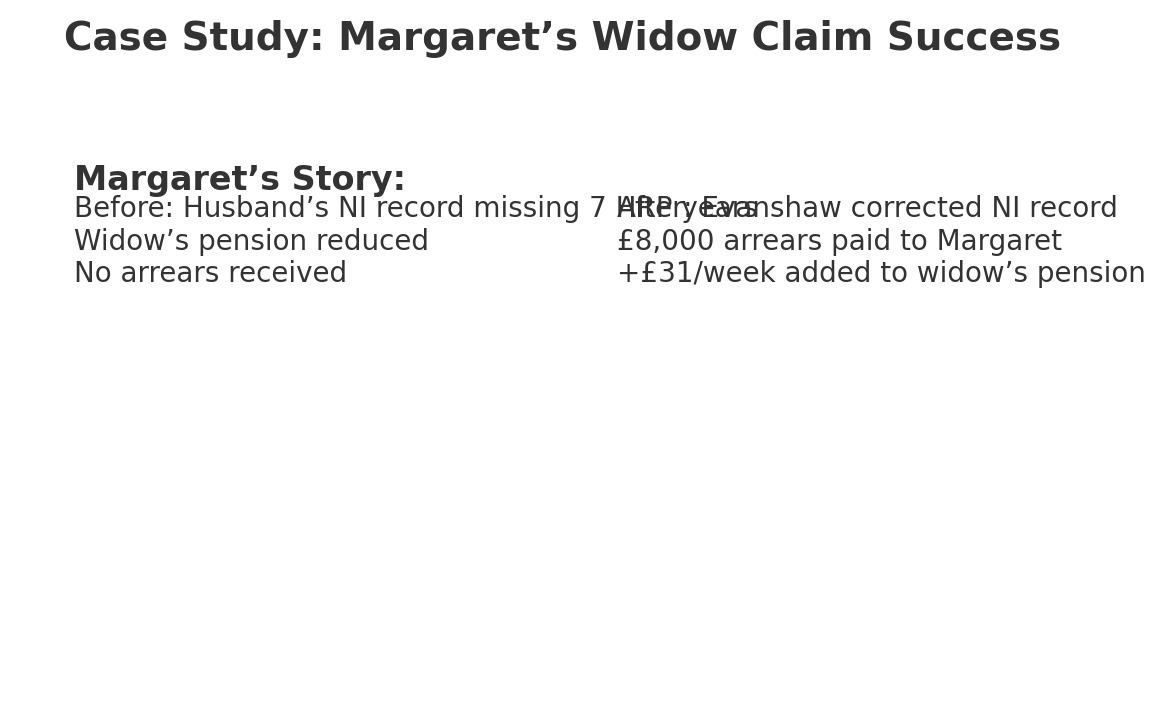

Case Study: Margaret’s Story

Margaret’s husband died in 2012. When she checked his NI record, she found 7 years of missing HRP. Evanshaw submitted a correction on her behalf. HMRC updated the record, and Margaret received £8,000 in arrears plus an extra £31 per week on her widow’s pension. This made a significant difference to her retirement income.

Frequently Asked Questions

Q: Can grandparents qualify for HRP?

A: Yes, if they were the named Child Benefit recipient for a grandchild.

Q: What if Child Benefit was in my spouse’s name?

A: HRP usually goes to the person named on the Child Benefit record. If this wasn’t you, you may not qualify.

Q: Can step-parents claim HRP?

A: Yes, if they were the official Child Benefit claimant.

Q: Does Carer’s Allowance automatically give HRP?

A: No. They are separate systems, although some carers qualified under both.

Q: Can HRP still be claimed today?

A: Yes. Claims can still be made for the period 1978–2010, even after retirement or death.

Final Step

👉 Not sure if you qualify for HRP? Don’t miss out on pension income you’ve earned. Use Evanshaw’s free eligibility tool — [Check Now](https://evanshaw.co.uk/carer/check-now/).